As the 2026 tax season kicks off, millions of Americans are preparing to file their federal income tax returns for the 2025 tax year. For many households, a tax refund is more than just extra money—it can help cover rent, utilities, school expenses, medical bills, or other essential costs. Understanding the IRS refund process can reduce stress and allow families to plan with confidence.

Key Filing Dates for 2026

The Internal Revenue Service (IRS) is expected to start accepting 2025 tax year returns in the final week of January 2026. While taxpayers can prepare their returns in advance using tax software or professional services, the IRS does not officially process submissions until the system opens. Filing early can be advantageous, as it positions your return closer to the front of the processing line.

The standard filing deadline for individual taxpayers is April 15, 2026. Although some may choose to wait until closer to the deadline, submitting returns early reduces the risk of delays caused by a high volume of submissions. It also provides extra time to correct any errors if issues arise during processing.

How Refunds Are Calculated

A tax refund occurs when taxes withheld during the year exceed the total tax owed. Factors that influence refund amounts include:

- Income level and withholdings

- Eligibility for tax credits, such as the Child Tax Credit, Earned Income Tax Credit, or education-related credits

- Life changes, including marriage, having children, or job transitions

Accurate reporting of income, deductions, and credits is critical for ensuring timely refunds and avoiding delays.

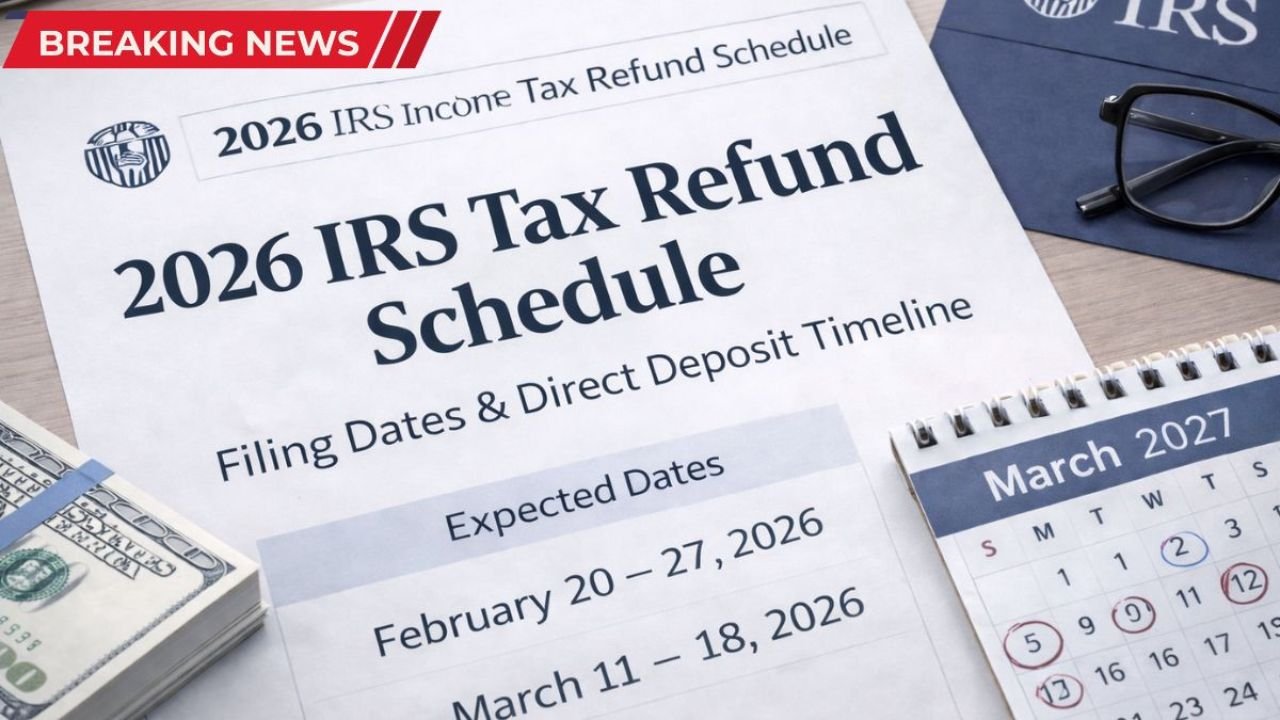

Refund Processing Timeline

There is no single refund schedule that applies to every taxpayer. Timing depends on several factors:

- Filing method – Electronic returns move through automated systems and are generally faster, while paper returns require manual review, which can add several weeks.

- Payment method – Choosing direct deposit is the fastest and safest option. Once a return is approved, funds are transferred electronically to the bank account, often within about three weeks of acceptance. Banks may require an additional one or two business days to complete the deposit.

- Additional verification – Returns claiming certain income-based or family-related credits may undergo extra review. Errors such as incorrect Social Security numbers, missing documentation, or inaccurate income details can also delay processing.

Direct Deposit vs. Paper Checks

Direct deposit remains the preferred method for receiving refunds. It eliminates mailing delays, reduces the risk of lost checks, and ensures funds arrive securely. Taxpayers who do not have direct deposit set up will receive a paper check, which can take longer to reach their mailbox.

Monitoring Your Refund

Taxpayers can track the status of their refund using the IRS “Where’s My Refund?” tool. This tool provides updates once a return is received, approved, and scheduled for payment. For convenience, the IRS2Go mobile app also offers real-time updates, making it easy to monitor progress from anywhere.

Tips to Avoid Delays

- File early – Submitting returns promptly reduces processing wait times.

- Use electronic filing – Speeds up the IRS review process.

- Select direct deposit – Ensures secure and fast receipt of funds.

- Verify information – Double-check Social Security numbers, income data, and bank account details.

- Include all required forms – Ensure proper documentation for credits and deductions.

What to Expect in 2026

For most taxpayers filing electronically with direct deposit, refunds are expected within three weeks of acceptance. Paper returns or filings requiring additional verification may take longer. Understanding these timelines allows households to plan for expenses and use refunds strategically.

Final Thoughts

A tax refund can provide crucial financial flexibility, helping families manage essential expenses or build savings. By filing accurately, choosing electronic submission, and using direct deposit, taxpayers can maximize the speed and efficiency of their refunds. Staying informed and proactive ensures a smooth filing experience and timely access to funds.

Disclaimer: This article is for informational purposes only and does not constitute tax, financial, or legal advice. Refund timelines, eligibility, and deadlines may vary based on individual circumstances and IRS policies. For personalized guidance, consult official IRS resources or a qualified tax professional.