As the 2026 tax filing season gains momentum, taxpayers expecting refunds are being urged to pay closer attention than ever to the accuracy of their returns. The Internal Revenue Service has cautioned that even small errors can trigger significant delays — and in some cases, temporarily freeze refunds.

For many households, tax refunds represent a critical financial boost. Whether allocated toward investments, debt reduction, tuition payments, or essential living expenses, delayed refunds can disrupt carefully planned budgets. Understanding why refunds may be placed on hold — and how to avoid it — is key to navigating this year’s filing season with confidence.

Why Direct Deposit Errors Cause Refund Freezes

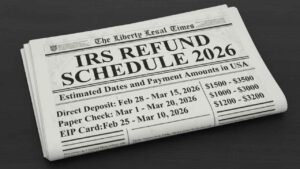

Electronic filing and direct deposit remain the fastest way to receive a refund. In most cases, taxpayers who file electronically and provide correct banking details receive their refunds within approximately 21 days after acceptance.

The system is largely automated. Once a return is accepted, digital verification checks begin. If everything aligns — income records, identity information, and bank details — the refund is transmitted electronically.

However, a simple mistake in entering a routing number or bank account number can disrupt the entire process.

If a financial institution rejects the deposit due to incorrect details, the refund does not immediately reroute back to the taxpayer. Instead, the payment is flagged within IRS systems. At that point, the automated process pauses, and manual intervention may be required.

Because the IRS has continued reducing paper-based processes in favor of digital systems, correcting these issues is not always instantaneous.

What Happens When a Refund Is Placed on Hold

When a direct deposit fails, the IRS typically issues a formal notice explaining the problem. Taxpayers are often given a limited window — commonly around 30 days — to respond and correct the information.

If the correction is submitted within the designated timeframe, the refund can usually be reissued electronically.

If no response is received, the IRS may eventually default to issuing a paper check. This adds multiple layers of delay:

- Additional internal processing time

- Physical printing and mailing

- Postal transit delays

What could have been a 21-day refund may stretch into several weeks or longer.

In certain cases, especially if discrepancies raise identity concerns, the IRS may request further verification before releasing funds. This additional review process can extend the delay significantly.

Increased Processing Pressure in 2026

The 2026 filing season presents additional challenges. Ongoing modernization efforts, regulatory updates, and workforce constraints have added complexity to return processing.

With more digital filters and compliance safeguards in place, returns that trigger system flags — even minor ones — may require manual review. That means accuracy is not just recommended; it is essential.

Errors that might previously have been resolved quickly may now move through longer review cycles.

Common Reasons Refunds Are Delayed or Frozen

While banking errors are a leading cause, several other issues can pause processing:

Incorrect Personal Information

Mismatched Social Security numbers, name discrepancies, or filing status inconsistencies can trigger review.

Income Reporting Differences

If reported income does not match employer or payer submissions, the system may halt the refund.

Missing Forms or Schedules

Incomplete returns frequently require manual intervention.

Identity Verification Flags

Fraud prevention filters are increasingly sophisticated. If a return is flagged, the taxpayer may need to verify identity before the refund is released.

Outstanding Federal or State Debts

Certain obligations may offset or reduce a refund before it is issued.

Each of these scenarios can lead to a temporary freeze until clarification is provided.

How to Protect Your 2026 Refund

Proactive preparation is the most effective strategy.

Double-Check Banking Details

Verify routing and account numbers directly from official bank documentation. Avoid copying numbers from memory or outdated records.

Review Personal Information Carefully

Ensure your name, Social Security number, and address match official records exactly.

File Electronically

Digital filing reduces manual data entry errors and speeds up processing.

Use an IRS Online Account

Creating an account through the official IRS portal allows you to monitor refund status, receive digital notices, and respond quickly if an issue arises.

Keep Documentation Accessible

Having W-2s, 1099s, and other supporting records readily available helps resolve discrepancies efficiently if contacted.

Spending an extra 10 to 15 minutes reviewing your return before submission can prevent weeks of frustration later.

How to Monitor Your Refund Status

Taxpayers can track refund progress through official IRS tracking tools. Status updates generally follow three stages:

- Return received

- Refund approved

- Refund sent

Updates typically occur once daily. If a deposit date appears, it is generally a reliable estimate of when funds will arrive in your account.

If your refund status shows no change beyond the typical processing timeframe, reviewing your IRS account or checking for mailed notices is advisable.

Financial Planning During Delays

For financially strategic households, a delayed refund can disrupt cash flow plans. Consider building flexibility into your financial strategy by:

- Avoiding commitments that rely solely on refund timing

- Maintaining an emergency savings buffer

- Scheduling discretionary expenses after funds are confirmed

While refunds are often anticipated, they should not be treated as guaranteed liquidity until deposited.

Final Thoughts

The 2026 tax season underscores a simple but powerful truth: precision matters. As the IRS continues to modernize and automate its systems, small errors — particularly in direct deposit details — can temporarily freeze refunds.

Electronic filing and direct deposit remain the most efficient path to receiving funds quickly. However, careful review of all personal and banking information is essential.

A few extra minutes of diligence before submission can protect your refund, preserve your financial timeline, and ensure a smoother tax season experience.

Disclaimer

This article is for informational purposes only and does not provide legal, financial, or tax advice. IRS policies, procedures, and refund timelines may change. Taxpayers should rely on official IRS communications or consult a qualified tax professional for guidance specific to their individual situation.