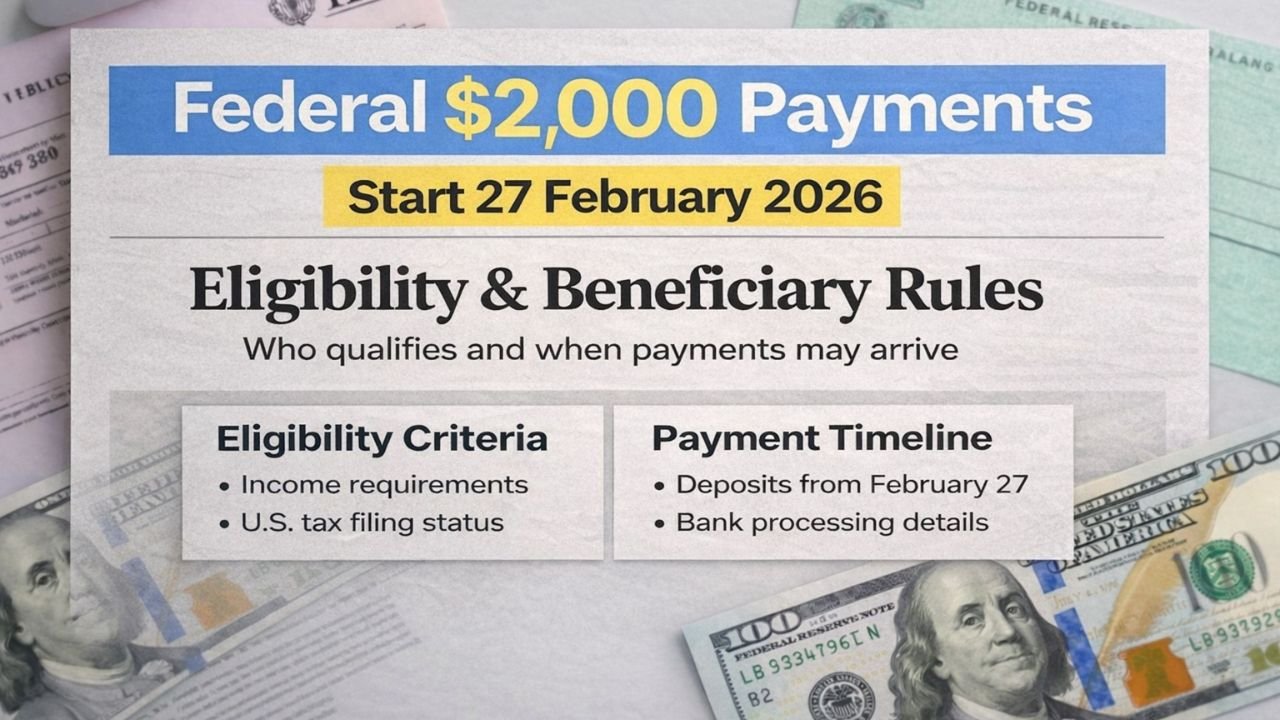

The idea of a federal $2,000 payment in February 2026 has captured widespread attention online. With households managing rising expenses—rent, groceries, healthcare, and utilities—news of potential government relief spreads quickly. However, it is crucial to distinguish confirmed information from speculation circulating on social media and unofficial sources.

Understanding the Proposed $2,000 Payment

The discussed $2,000 amount is described as a one-time federal relief payment, designed to provide temporary financial support. It is not linked to regular benefits such as Social Security retirement, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), or veterans’ programs. Additionally, it is separate from IRS tax refunds.

While the purpose would be to alleviate financial pressure for households facing high living costs, the payment currently exists only as a public discussion. No formal plan or legislative authorization has been issued.

No Official Approval Yet

As of February 2026, no official confirmation exists regarding the issuance of a $2,000 payment. Congress has not enacted legislation to authorize it, and government agencies such as the Internal Revenue Service and the Social Security Administration have not announced any new programs. Without formal approval and clear guidance, the payment cannot proceed, and it should not be considered guaranteed income.

Potential Eligibility Guidelines

If a $2,000 federal payment were approved, eligibility would likely mirror patterns from previous relief programs. While details remain speculative, possible priority groups might include:

- Low- and moderate-income households

- Retirees and senior citizens

- Recipients of SSI or SSDI

- Veterans

- Taxpayers meeting specific income thresholds

Exact eligibility rules would only be made official after legislation is passed or an agency announcement is issued.

Possible Distribution Methods

Past government relief programs suggest that any approved payment would likely be distributed using existing government records. Key considerations include:

- Direct deposit for recipients with updated banking information, ensuring the fastest delivery

- Paper checks or prepaid debit cards for those without direct deposit accounts

- Automatic issuance, meaning most recipients would not need to submit a separate application

Using existing administrative channels allows for efficient distribution, reducing delays and minimizing the need for manual applications.

Why February 2026 Is Being Discussed

February often coincides with tax refund schedules and benefit cycles, which may explain why discussions and rumors focus on this month. While a specific February timeline has been mentioned online, it is not confirmed by any official government source. Any claim of a precise February payment date should be approached cautiously until verified.

Key Takeaways for Households

- Do not rely on the $2,000 as guaranteed income. Any mention of February payments is speculative.

- Monitor official sources like the IRS, Social Security Administration, and congressional announcements for accurate updates.

- Prepare financial plans based on known income streams rather than potential relief payments.

- Keep personal information updated with banks and government agencies to facilitate quick delivery if a program is authorized.

Staying Informed

As discussions around federal relief continue, it is essential for households to stay informed and rely on credible sources. Misinformation can create confusion and unrealistic expectations. For confirmed updates, taxpayers should consult:

- IRS official announcements for payment or tax-related updates

- Social Security Administration bulletins for beneficiary-specific information

- Congressional press releases regarding any new relief legislation

Final Thoughts

The concept of a $2,000 federal payment in February 2026 highlights ongoing concerns about the cost of living and the need for financial relief. While the conversation is widespread online, it remains unapproved and speculative. Households should remain cautious, track official announcements, and plan their finances around verified income sources.

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. No $2,000 federal payment has been officially approved. Program details, eligibility rules, and timelines are subject to change based on government decisions. Readers should verify updates through official government sources.