As the 2026 tax season begins, millions of Americans are preparing W-2s, 1099s, investment statements, and deduction records to file their federal returns. For many households, a tax refund is more than a routine transaction—it can strengthen savings, reduce credit balances, fund investments, or provide breathing room in a high-cost environment.

Understanding when refunds are issued, how amounts are calculated, and why delays occur can help you plan with clarity and confidence.

When Does the IRS Begin Issuing Refunds in 2026?

The Internal Revenue Service (IRS) typically begins accepting federal tax returns in late January. Once your return is submitted and officially accepted, processing begins.

For taxpayers who file electronically and choose direct deposit, refunds are often issued within 10 to 21 days, provided there are no errors or additional verification requirements.

Paper-filed returns take longer because they must be manually opened, reviewed, and entered into IRS systems. Choosing direct deposit instead of a mailed check also shortens delivery time.

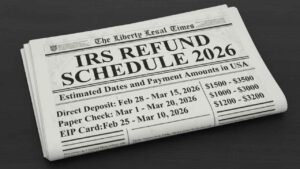

Estimated 2026 Refund Timeline

While exact dates vary based on when you file, a general timeline looks like this:

- Late January: IRS begins accepting returns

- Early to Mid-February: Early filers may begin receiving refunds

- March to April: Peak processing period for most taxpayers

- After April deadline: Later filers receive refunds based on submission date

Filing early with complete and accurate information remains the most effective way to receive your refund promptly.

How Federal Tax Refunds Are Calculated

A tax refund occurs when the total federal income tax you paid throughout the year exceeds the amount you actually owe after filing your return.

The IRS calculates your refund by comparing:

- Total income reported

- Adjustments and deductions

- Tax credits claimed

- Total federal tax withheld or prepaid

If withholding and estimated payments are greater than your final tax liability, the difference is refunded to you.

Key Factors That Influence Refund Amounts

Refund amounts vary widely because each tax situation is unique. Influencing factors include:

- Changes in income

- Filing status

- Number of dependents

- Eligibility for tax credits

- Adjustments to withholding during the year

- Self-employment or investment income

Even small changes—such as a raise, freelance work, or updated withholding forms—can significantly impact your refund compared to prior years.

How 2026 Refund Amounts May Compare to Previous Years

Refund totals fluctuate from year to year due to evolving tax laws, income trends, and changes in personal circumstances.

Recent tax seasons saw shifts after pandemic-era relief programs ended and withholding patterns stabilized. In 2026, refund amounts will largely depend on:

- National wage growth

- Adjustments to tax brackets

- Credit eligibility updates

- Individual earnings changes

For some taxpayers, refunds may increase due to higher withholding or expanded credits. Others may see smaller refunds if income rose significantly without adjusting withholding.

It’s important to remember: a larger refund is not necessarily better. It often means you paid more tax than necessary during the year. Strategic withholding planning can help optimize monthly cash flow instead of waiting for a large annual refund.

Why Some Refunds Take Longer Than Others

Not all returns move through the system at the same speed. Several common issues can delay processing:

- Incorrect Social Security numbers

- Mismatched income reporting

- Missing forms

- Incorrect bank account details

- Mathematical errors

- Claims requiring additional verification

Certain tax credits are subject to enhanced review processes to prevent fraud and identity theft. While this may extend processing time slightly, it strengthens overall system security.

Increased fraud prevention measures mean the IRS may temporarily hold some refunds for verification. Responding promptly to any official notice helps avoid extended delays.

How to Track Your Refund Status Safely

The IRS provides an official online tracking tool that allows taxpayers to monitor refund progress in real time.

The system typically displays three stages:

- Return Received

- Refund Approved

- Refund Sent

To check your status, you will need:

- Social Security number or taxpayer identification number

- Filing status

- Exact refund amount shown on your return

The tracker updates daily. Using official IRS tools protects against phishing scams or fraudulent refund notifications.

The IRS does not request personal information via unsolicited texts, emails, or social media messages.

Planning Your Budget While Waiting for Your Refund

Financial professionals recommend avoiding reliance on a refund for urgent or time-sensitive expenses until it is officially approved.

While most electronic filings process within weeks, unexpected reviews or corrections can extend timelines. Maintaining an emergency fund provides financial flexibility if processing takes longer during peak filing periods.

If you intend to use your refund for:

- Paying down high-interest debt

- Building an emergency savings cushion

- Investing for long-term growth

- Funding major purchases

Create a flexible financial plan that accounts for potential timing variations.

Understanding Refund Offsets and Adjustments

Not every taxpayer receives a refund. Some may owe additional tax if withholding was insufficient or if estimated payments were underpaid.

Additionally, certain outstanding obligations can reduce or redirect a refund under federal rules. These may include:

- Unpaid child support

- Certain federal debts

- Other qualifying government obligations

If your refund is adjusted or offset, the IRS will send an official notice explaining the reason.

Reviewing employer forms, confirming personal information accuracy, and double-checking banking details before filing can significantly reduce the risk of delays or corrections.

Filing Smart in 2026

To streamline your refund experience:

- File electronically

- Choose direct deposit

- Double-check Social Security numbers and income forms

- Retain copies of all documents

- Respond promptly to any official IRS communication

Accurate filing not only speeds up processing but also strengthens financial planning for the year ahead.

Final Thoughts

Tax season can feel complex, but understanding the 2026 IRS refund schedule empowers you to plan with clarity. Most taxpayers who file electronically and accurately can expect refunds within a few weeks. However, individual circumstances, verification requirements, and filing methods all influence timing.

A refund represents the return of overpaid taxes—not bonus income. Approaching it strategically can help you strengthen savings, reduce liabilities, or support long-term financial goals.

Staying informed, filing accurately, and monitoring your status through official channels ensures a smoother tax season in 2026.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Refund amounts, processing times, and eligibility depend on individual circumstances and official IRS procedures. For guidance specific to your situation, consult official IRS resources or a qualified tax professional before making financial decisions.