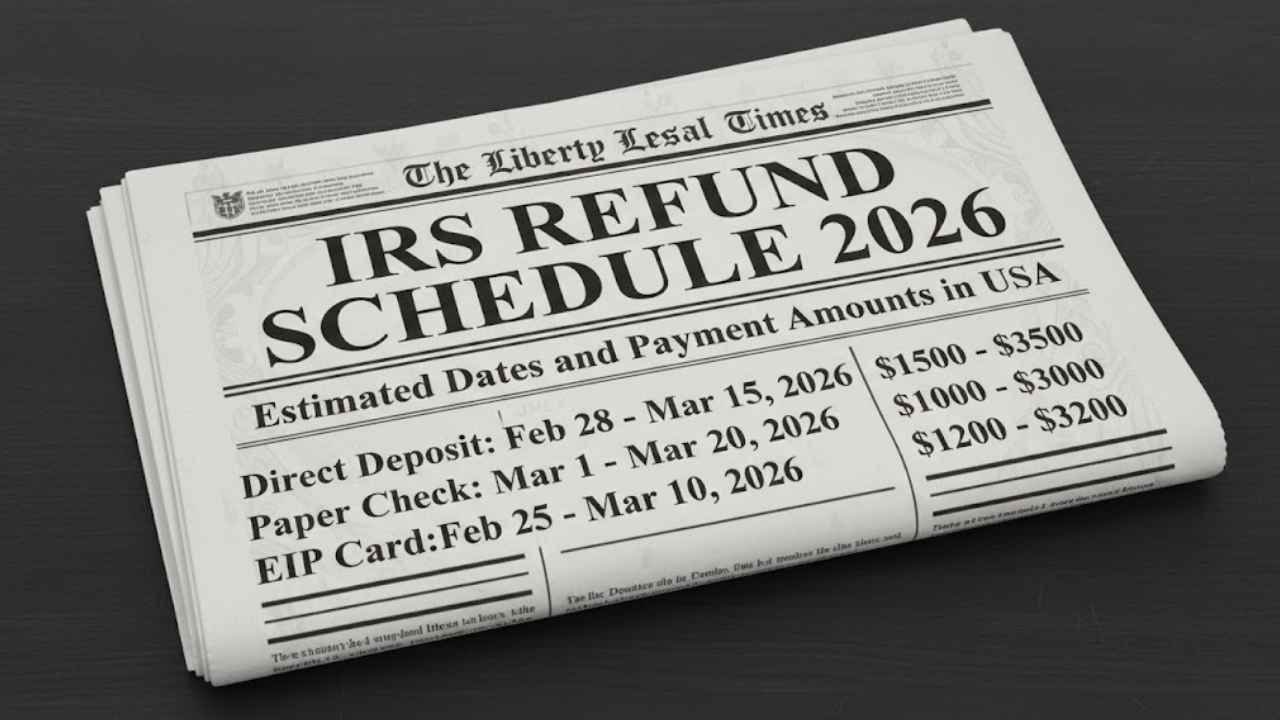

IRS Tax Refund Schedule 2026: What to Expect and When

Tax refunds are more than just a financial windfall—they offer millions of Americans crucial breathing room in their budgets. Whether used to pay rent, cover utility bills, reduce debt, or bolster savings, a timely refund can make a significant difference in household finances. As the 2026 tax season unfolds, understanding the IRS tax refund schedule … Read more